Embark on a quest to master the intricate world of forex analysis. This in-depth guide will equip you with the knowledge to decipher market trends, spot profitable opportunities, and steer the volatile realm of currencies. From fundamental analysis to graphical indicators, we'll uncover every facet of forex analysis, empowering you to make strategic trading decisions.

- Comprehend the basics of forex trading.

- Learn key technical analysis tools and indicators.

- Hone a robust trading strategy based on research.

- Mitigate risk through proper position sizing and stop-loss orders.

- Keep up-to-date with market developments.

Unveiling the Secrets of Fundamental Forex Analysis

Embark on a journey to master the intricacies of fundamental forex analysis. This powerful methodology empowers traders to interpret economic indicators, geopolitical events, and market sentiment to forecast currency movements with greater accuracy. By delving into global trends, you can discern hidden opportunities in the forex market and make calculated trading decisions.

- Unpack the influence of interest rates, inflation, and GDP growth on currency valuation.

- Measure the impact of political stability, trade agreements, and central bank policies on market sentiment.

- Utilize news events, economic reports, and technical analysis to corroborate your fundamental insights.

Unlocking Profit Potential with Technical Forex Analysis

Technical analysis of the forex market holds the key to unlocking substantial profit potential. By meticulously examining price charts, traders can identify recurring formations that indicate future price action. Leveraging technical indicators and tools, traders can derive valuable insights into market sentiment and upcoming price fluctuations.

Through astute technical analysis, traders can amplify their chances of returns in the volatile forex environment.

Unlocking Forex Trading Analysis for Beginners

Embarking on your forex trading journey can seem daunting, especially when confronted with the complexities of analysis. However, understanding the fundamentals of forex analysis doesn't have to be a difficult task. This article aims to clarify key concepts and belajar trading forex emas equip you with the knowledge to understand the world of forex trading analysis with confidence. We'll delve into technical analysis, exploring tools and indicators that can assist your decision-making process. By grasping these principles, you'll be well on your way to achieving informed trading decisions and potentially improving your forex trading success.

- Essential concepts in forex analysis

- Technical analysis techniques

- Metrics to interpret market trends

- Risk management

Embarking On The Art of Forex Analysis: From Novice to Expert

Mastering the intricacies of foreign exchange requires a keen eye for detail and a solid understanding of market dynamics. As a beginner, your journey initiates with fundamental analysis, scrutinizing economic indicators, geopolitical events, and news headlines that impact currency rates. As you progress, delve into technical analysis, harnessing charts, patterns, and indicators to decode price fluctuations. With consistent practice and a thirst for learning, you can transform from a novice into a seasoned Forex expert.

- Cultivate your analytical skills through continuous learning and practice.

- Adopt diverse analytical tools and strategies to gain a holistic view of the market.

- Remain informed about global events and their potential impact on currency pairs.

A Practical Approach to Successful Forex Trading Analysis

Successful forex trading demands a comprehensive understanding of market trends and the ability to evaluate complex financial data. Novice traders often struggle to master the intricacies of the forex market, leading to disappointing trading experiences. However, a practical approach to analysis can empower traders to execute informed decisions and boost their chances of success.

A core component of any successful forex trading strategy is the use of technical analysis tools. These instruments provide insights into past price movements and highlight potential future trends. Traders should familiarize themselves with various indicators such as moving averages, RSI, and MACD, which can guide in determining entry and exit points for trades.

Additionally, fundamental analysis plays a crucial role in understanding the underlying economic factors that influence currency values. Traders should stay informed about global economic events, interest rate differentials, and political developments that can alter market sentiment and impact currency pairs.

- Implement a trading plan with clear entry and exit criteria based on your analysis.

- Monitor risk effectively by setting stop-loss orders to limit potential losses.

- Continuously review and refine your trading strategy based on market conditions and your own performance.

Alana "Honey Boo Boo" Thompson Then & Now!

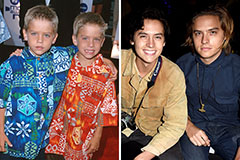

Alana "Honey Boo Boo" Thompson Then & Now! Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Michael Bower Then & Now!

Michael Bower Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now!